Managing accounts receivable (AR) properly is more important in today’s fast-paced corporate climate. Automating AR operations is no longer a luxury for businesses juggling several customers and transactions; it is a need. Automation guarantees tax law compliance and helps cash flow management, reducing the possibility of penalties and conflicts. This blog looks at how companies might use accounting software and artificial intelligence to improve tax reporting, simplify AR procedures, and negotiate the complexity of tax compliance.

The Role of Accounts Receivable in Tax Compliance

Accounts receivable, sometimes known as money owed to a company by its consumers for credit-based purchases of goods or services, are assets that also carry responsibilities. Inaccurate financial reporting resulting from improper AR management influences tax filing. AR mistakes can set off audits, cause fines, or harm a company’s reputation.

Correct records determine tax compliance. For example, sales tax responsibilities typically rely on AR data, particularly in nations with differing tax legislation. Companies must ensure that their AR records match tax standards to avoid discrepancies. Automation provides the means to ensure compliance and correctness.

Benefits of Automating Accounts Receivable

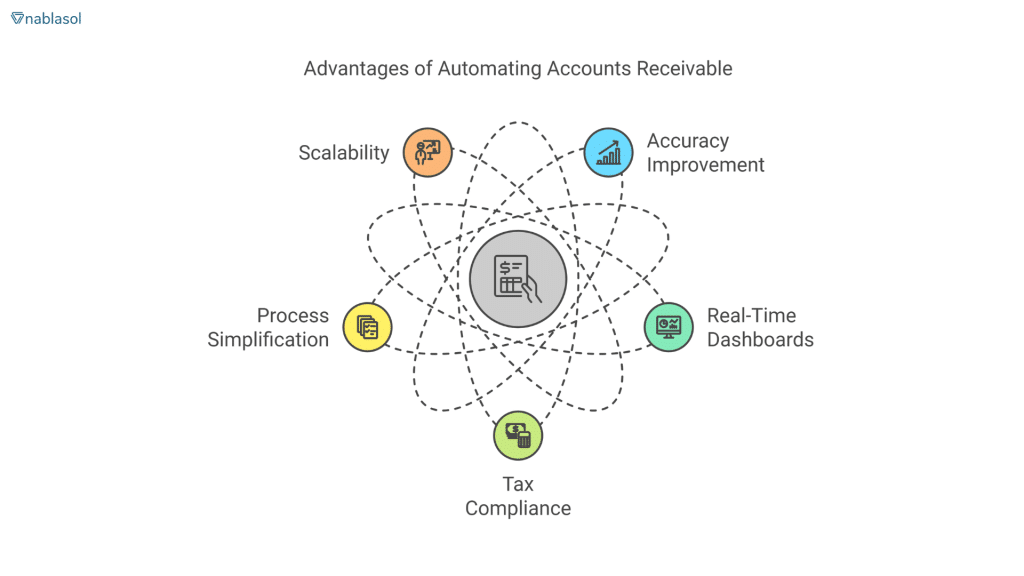

Automating AR systems speeds up procedures, lowers human error, and helps to simplify complex tasks. AR automation offers several main advantages for tax compliance below:

- Automation improves accuracy by reducing manual data input errors, resulting in accurate records for financial reporting and tax calculations.

- Automated solutions provide real-time dashboards to easily manage outstanding invoices, payment trends, and tax liabilities.

- AR automation technologies interface with tax software to ensure compliance with local, state, and federal standards.

- Automation removes repetitive processes, freeing financial teams to focus on strategic planning and dispute resolution.

- As businesses grow, AR processes become more complex. Automated solutions can quickly scale to accommodate higher transaction volumes.

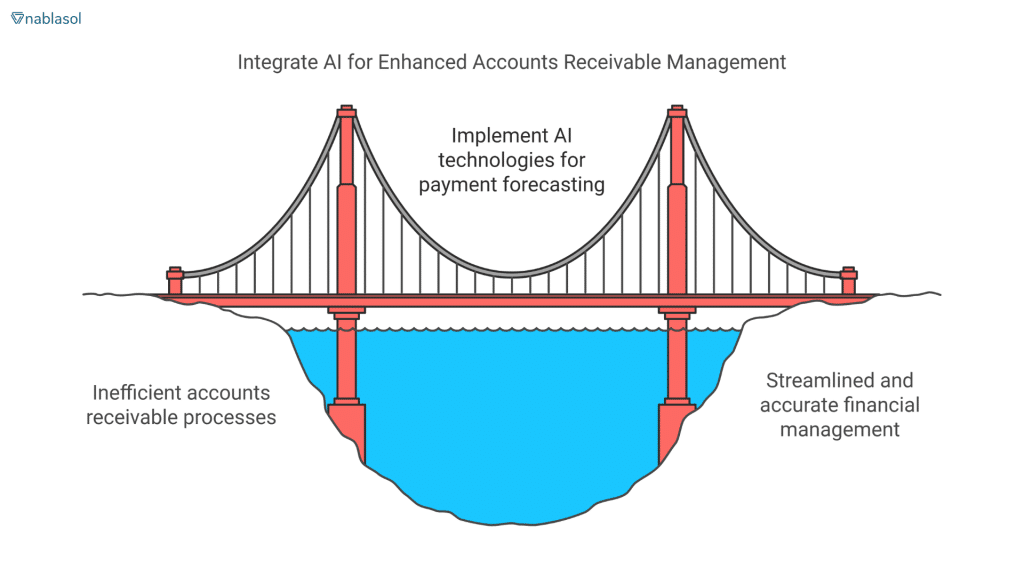

How AI Enhances AR Automation

- Artificial intelligence (AI) has transformed how firms manage accounts receivable. AI-powered technologies can forecast client payment behavior, detect potential hazards, and provide tactics for increasing collection rates.

- AI can use historical payment patterns to predict when invoices will be paid. This helps businesses better manage their financial flow.

- Machine learning algorithms automatically match payments with invoices, decreasing reconciliation time.

- AI systems can identify anomalies or unusual transactions, which can assist businesses in preventing deception and guaranteeing precise tax reporting.

- Businesses integrating AI into AR management may mitigate regulatory concerns while optimizing financial processes.

Integrating AR Systems with Tax Reporting

One of the most significant advantages of AR automation is its seamless integration with tax reporting systems. This integration ensures that all financial and tax records are consistent and improves data flow.

Centralized Data Management: Automated AR tools consolidate all invoice and payment data in one platform. This centralization makes it easier to generate accurate tax reports.

Tax Code Application: Many AR systems are equipped with tax rule libraries. These tools automatically apply the correct tax rates based on transaction details, reducing the risk of under- or overpayment.

Simplified Audits: Integrated AR systems maintain detailed records, making responding to tax authority inquiries or audits easier.

Real-Time Compliance Monitoring: Some solutions offer alerts for tax filing deadlines and changes in tax regulations, ensuring businesses remain compliant.

Avoiding Tax Penalties Through Automation

Tax penalties often stem from errors in reporting or late filings. Automation minimizes these risks by ensuring accurate and timely data submission. Here’s how:

- Error Reduction: Automated systems validate data before submission, catching mistakes that could lead to penalties.

- Timely Reminders: Many AR platforms include automated reminders for tax deadlines, ensuring on-time filing.

- Consistent Updates: Cloud-based systems are frequently updated to reflect changes in tax laws, keeping businesses compliant.

Best Practices for Implementing AR Automation

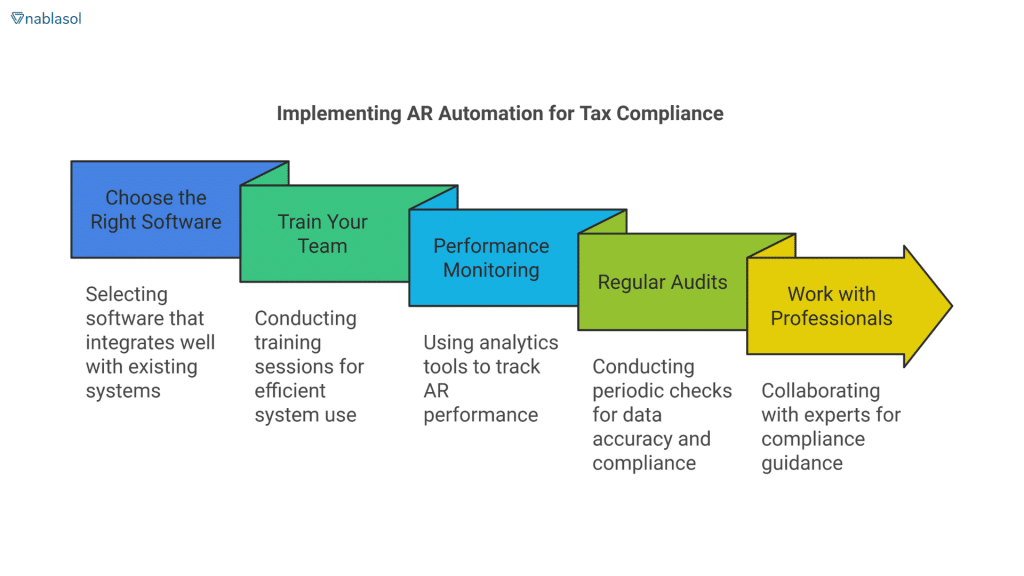

To fully leverage AR automation for tax compliance, businesses should follow these best practices:

Choose the Right Software: Select software that works seamlessly with your current accounting and tax software. Consider features such as predictive analytics, configurable dashboards, and compliance monitoring.

Train your team: Ensure your financial team understands how to use the new system efficiently. Regular training can help them reap the full benefits of automation.

Performance monitoring: Employ analytics tools to monitor the performance of your AR procedures. Identify areas that require enhancement and implement the necessary modifications.

Regular audits: Perform periodic internal audits to confirm the correctness of your AR data and compliance with tax requirements.

Work with professionals: Work with tax or financial professionals who can help you navigate burdensome compliance obligations.

The Future of AR Automation

As technology advances, the capabilities of AR automation tools will grow. Emerging trends include:

- Blockchain for AR Management: Blockchain technology may improve transparency and security in AR procedures, making tax compliance even more trustworthy.

- Robotic Process Automation (RPA): RPA can do high-volume processes such as invoice production and payment processing with little human intervention.

- Advanced AI Applications: Future AI tools could provide better predictive accuracy and real-time compliance insights.

Conclusion

Automation in accounts receivable management is a game changer for organizations looking to be tax-compliant. Companies can use AI and accounting software to streamline AR procedures, decrease errors, and avoid costly penalties. Integrating tax reporting systems guarantees that financial records are consistently accurate and auditable.

Automation enables firms to avoid compliance issues in an increasingly complicated regulatory context while improving cash flow and operational efficiency. Adopting these technologies allows for a more resilient and prosperous future.

Would your company profit from AR automation? Begin researching tools and tactics for remaining compliant and efficient today.